The Ultimate Guide to Spend Management

For many years, Procurement’s most important role has centered around tactical purchasing and cost reductions. The less money a business spends, the more Procurement has succeeded. But as the global economy has become more connected and conflicts, emergencies, and disasters have made supply chains more complicated, the function’s role has had no choice but to evolve. Now, one of Procurement’s defining activities is spend management.

But what does that mean in the scope of a large, global business? And what does enterprise spend management look like on a daily basis? We’ll answer these questions and many more here in the ultimate guide to spend management.

What is Spend Management?

Running a business is an expensive venture. Not only do organizations have to buy the supplies that they use to make their products (also known as Direct Procurement), but they also have to buy the goods and services that allow the business to operate day after day (also known as Indirect Procurement). Overseeing, influencing, and at times controlling these purchases is one of Procurement’s main roles.

On the surface, this may seem like a simple process, but it’s far more involved than simply looking at spreadsheets and determining how much the organization spent in a given time period. Because Procurement spend management is entirely focused on purchasing, it involves taking an in-depth look at how much money the company spent as well as what category they spent it in and which vendors they did business with. Then Procurement decides which changes will benefit the business by saving money, protecting the business’ interests, or improving operations. In short, spend management is the process of empowering businesses by managing what they buy.

As you can probably tell, Procurement spend management is not the same as reconciling financial data. Unlike high-level financial exercises that rely on top-down reports and balance sheets, the information Procurement needs to make spend management decisions is granular. It lies in purchasing data, so to find opportunities, teams start with a spend analysis.

Spend Analysis

A spend analysis is the process of exploring and evaluating what an organization has purchased, how much it cost, and who it bought from to identify opportunities for improvement. It’s an in-depth exercise that involves asking hard questions about all of a company’s spending behavior, but before a business can start, it needs spend visibility.

What is Spend Visibility?

Spend visibility is the state of having all of an organization’s purchasing data in one spend analysis tool so Procurement can see it as a whole. That means pulling data from P2P and S2P suites, P-cards, ERPs, T&E platforms, business intelligence tools, and any other system that the company uses to purchase goods and services or submit purchase orders (POs).

Of course, getting all this data involves a significant amount of work, so some teams settle for the information in their suites. They assume that since most of their purchases go through these platforms, they’ll have most of the company’s spend data. Unfortunately, history tells us that these solutions hold less than 40% of the information Procurement teams need to make effective, holistic decisions. To effectively analyze and manage spend, a business needs visibility into all of its spend data.

However, consolidating this information doesn’t automatically give a company spend visibility. Because the Procurement tech landscape is filled with so many different platforms, pulling this data leaves teams with hundreds or thousands of different files. Additionally, each purchasing platform has its own way of formatting files and the data is nearly guaranteed to have several variations of a supplier’s name. Finally, none of the data comes organized into useful categories. These four problems together mean that Procurement’s raw data is messy and far too large for teams to clean, normalize, and categorize into a spend taxonomy manually.

Using AI in Procurement to Achieve SpendVisibility

AI in Procurement is an interesting topic because there are so many different applications for the technology. But when it comes to cleaning, normalizing, and categorizing millions of rows of spend data, there’s no better option than procurement AI.

Artificial intelligence exists to quickly interpret complicated information, so it’s particularly useful for cleaning and organizing the data that will go into spend analysis software. Armed with machine learning, fuzzy match, natural language processing, and its previous experience with enterprise spend data, an AI model can search through vendor names, GL codes, product descriptions, and other relevant purchase information to identify important characteristics about each purchase. These include:

- What category and subcategory the purchases fit into

- What supplier each purchase came from

- Which vendor names correspond to each other

- What location or buyer made the purchase

- Corresponding spend identifiers such as PO #, Invoice #, etc.

Because these descriptors are granular, cleaning, organizing, and entering this data into a procurement dashboard manually is too time-intensive to be worth the work. But when AI helps handle the data, procurement teams can achieve spend visibility within a few days and then turn to the reason spend visibility matters in the first place: spend analytics.

Advantages of AI-powered Spend Management

Data quality is the primary roadblock to building an effective spend management strategy. The issues with data come in a variety of forms:

- Fragmented data from multiple ERPs, P-cards, etc.

- A never-ending flow of granular, raw data

- Multiple file types, naming conventions, and organization structures

These problems severely limit Procurement’s ability to understand spending and the function’s opportunities to impact it. They also distract procurement talent from finding and acting on these opportunities by forcing teams to clean, manage, and analyze data manually.

While every recent panel, webinar, and whitepaper seems to have a new way to revolutionize Procurement using AI, data management is a well-established and proven use case for doing just that. According to a study by Hobson & Company, using AI to normalize, categorize, and refresh spend data can slash a team’s data responsibilities by 80% on average.

Using AI to speed up data collection and management can also

- Give teams a nearly real-time flow of updated information with monthly refreshes

- Automatically turn fragmented raw transaction data into centralized spend intel

- Eliminate or reduce expenses dedicated to data science and cleanup resources

- Deepen involvement in financial and ESG strategy without requiring manual digging

SpendHQ has used a combination of procurement expertise and machine learning to consolidate spend for years. Our process looks something like this:

- We gather current and historical data from every source – ERPs, suites, P-Cards, and other systems.

- We feed these files into our proprietary system, developed by internal data experts and former procurement consultants. This model has cleaned, categorized, and analyzed $8+ trillion of spend.

- Normalize: Most companies have multiple naming conventions for each vendor, which can make it difficult to get an accurate picture of spend with even one supplier. Using Natural Language Processing (NLP) and Machine Learning (ML), our model pulls on its extensive data lake to compare vendor names across files and consolidate them into a single naming suggestion.

- Our team of procurement experts reviews and confirms the suggested output with the client.

- Categorize: Our model uses NLP and ML to compare spend to its data lake again. But this time, it fits transactions into categories and subcategories based on what the purchase is instead of the business unit that bought it or the vendor it was purchased from.

- Once again, we work with the client to verify the categorization.

- Enrich: Using our list of data partnerships, we inject additional data into the new spend cube, allowing teams to extend their spend intelligence to include supplier insights like sustainability, diversity, financial risk, and cyber risk.

- Refresh: You don’t have spend visibility if it’s just a snapshot in time. Every month or quarter, depending on the client’s preference, we repeat the above process to update their spend data. And because the process is based in ML, it gets faster and more accurate every time.

Learn more about what makes SpendHQ’s data consolidation effective…no matter how messy or fragmented the data is.

Conducting a Spend Analysis in Procurement

Getting to spend visibility is great, but it only provides a basic look at what a company bought and how much it cost. To truly manage spend, Procurement needs to identify purchasing trends, how they’re affecting the company, and what the function can do about them. That requires taking a critical look at the granular details of where the company is spending.

The first step in analyzing spend is to take note of how much money the business is spending in each category. This will tell you where the company has been busiest or has the most needs. It will also help you identify the categories that need your attention first. For instance, if costs in a category are much higher or lower than you expected, there might be a sourcing issue that needs your attention.

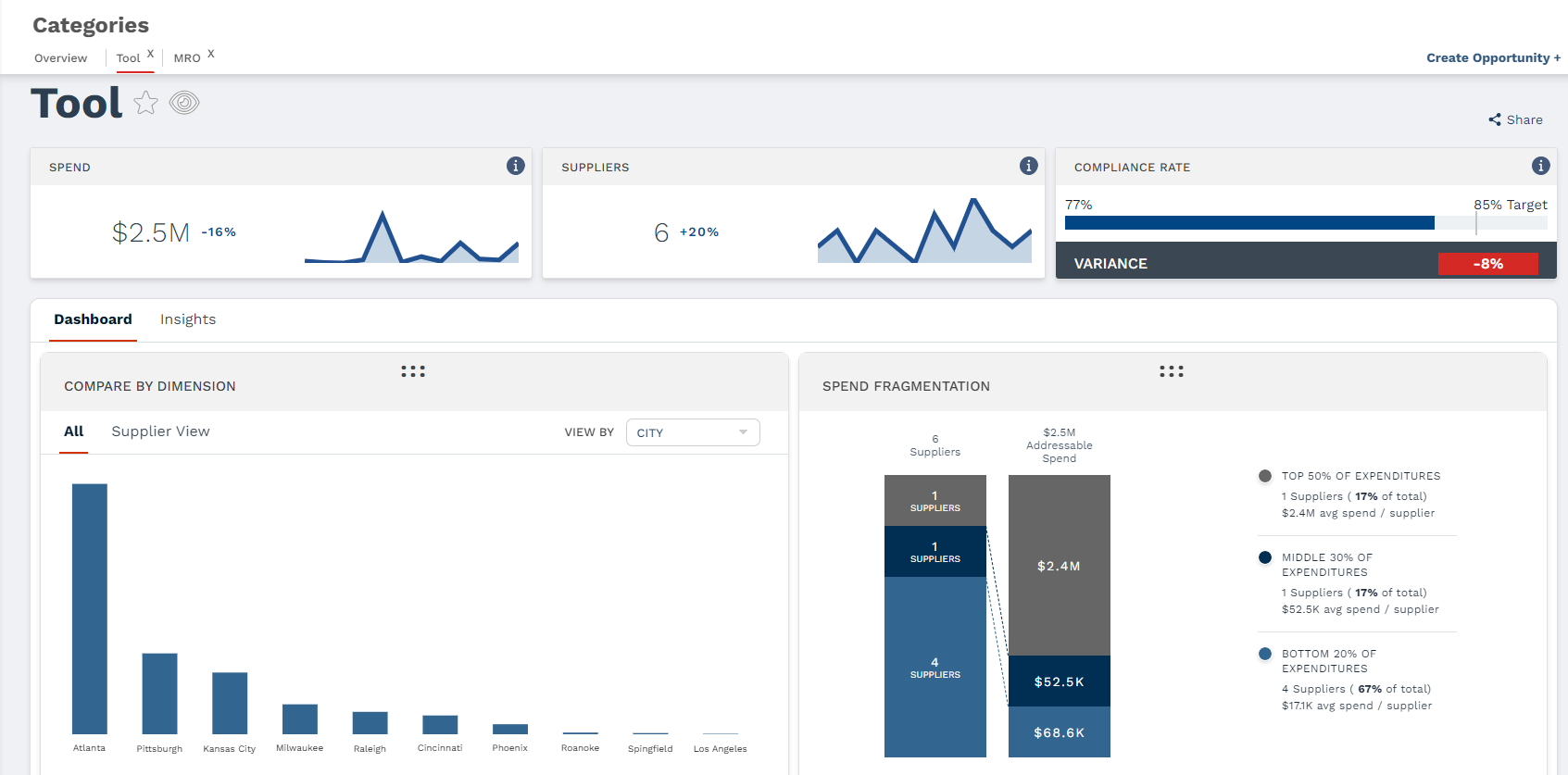

Once you pick a category to focus on, you’re ready to drill down into the subcategories. Doing so will reveal more in-depth information and also help you pinpoint specific areas for improvement. For example, instead of looking at MRO as a bulk category, you can explore individual facets of maintenance spend, like valves, tires, or tools.

Drill down into subcategories makes spend management efforts more focused, which means Procurement teams find more cost savings opportunities.

After you’ve looked at your subcategories, you can drill down even deeper and see which vendors make up each one and how much the company is spending with each of them. Like subcategories, this adds an extra layer of depth by revealing who the business is spending with and even how much spend in the subcategory is going to each vendor.

This information is crucial for choosing preferred suppliers and entering into contracts. Breaking subcategories down by vendor also reveals supply chain gaps and lack of vendor depth, which the company can use to avoid risk. So while analyzing spend from a category or subcategory perspective is crucial, viewing it from the vendor level is where teams usually find the greatest opportunities for improvement.

Improving Spend Management Processes

Visibility is the first step to spend management, but processes make it automatic, consistent, and reliable. The right spend management processes for your business will depend on the maturity of your procurement organization, your operating model, the size of the business, and the size of your team. However, there are a few general tactics that will help you build or improve your processes.

Leverage Technology do to What you Can’t

Procurement oversees so much purchasing activity that managing and monitoring it manually is impossible. Instead, use your digital tools to automate spend monitoring, surface buried improvement opportunities, and log outcomes in a single source of truth.

EmbedAutomated Controls

If you treat non-compliance and savings leakage as something you respond to, your job will look like a game of whack-a-mole. Instead, lock your purchasing programs in place with automated controls like P-cards and limit purchasing options with e-sourcing tools and purchasing catalogs.

Eliminate Silos

Management of every type decays in silos because they breed disconnection and miscommunication. If you find a silo, break it down with communication and transparency.

Centralize procurement project tracking in a place everyone can see. Talk to stakeholders and business units about budgets and ways you can help with management. When you find spend overlaps in your spend analytics tool, share that information visually. Over time, spend management can take its place at the heart of every business unit’s path to success.

Spend Intelligence: Going Beyond Analysis

Drilling down across these three levels is a great way to analyze spend, but alone it can leave Procurement with the same problems as spend visibility. The obvious issues will jump off the page, but after addressing them, Procurement likely won’t have maximized how much spend the company is managing. In fact, this can cause Procurement to miss the most impactful addressable spend opportunities simply because they’re harder to find.

To solve this issue, many teams take analytics a step further and turn to spend intelligence. Spend intelligence gives teams tools and visualizations that allow them to discover and evaluate highly specific trends or aspects of their data.

The first way that spend intelligence does this is with customizable filters that allow users to view highly specific aspects of spend from unique angles. For example, if a category manager wants to isolate the cause of small parcel shipping cost increases, they can slice and dice the data to hone in on the responsible location or buyer. Of course, this is just one example; slicing and dicing allows Procurement to find anything in its data, no matter how broad or granular. By allowing teams to see spend from eye-level, it helps them find more opportunities, problems, and challenges in their data.

The second way that spend intelligence supplements a spend analysis is by highlighting the facts in a company’s data that matter most but would be difficult to find manually. These include tail spend, spend fragmentation, percent spend change, compliance rates, savings leakage amounts, and much more. In a sense, having easy access to this information does a bulk of the analysis for Procurement, meaning teams can focus on driving impact instead of looking for it.

The final ability that defines spend intelligence is its customization. In addition to the way a spend intelligence solution highlights key information, it also allows teams to create customizable dashboards that put the information they deem critical front and center. Not only does this allow Procurement to track the most important trends in real-time, but it also makes it easy to share them with stakeholders and explain what the team is working on.

What to Look for When Analyzing Spend

As we’ve established, costs savings and cost avoidances aren’t the sum of Procurement’s responsibilities anymore. So when conducting a spend analysis, there are four primary areas that Procurement professionals focus on:

- Cost savings opportunities

- Compliance

- Risk

- Non-financial objectives

Cost Savings Opportunities

A cost savings opportunity, also known as an addressable spend opportunity, is the classic Procurement project—any purchasing trend that the function can impact either by decreasing it or eliminating it altogether. Procurement teams identify these opportunities by looking for areas where they have an opportunity to lower spend. For example, a team might drill down into a subcategory and find that the company is spending with five vendors when it could consolidate down to two or three preferred vendors. Alternatively, a CPO could find that spend with a supplier has increased by 70% over the last year, meaning she has a contract opportunity that could cut per unit prices significantly.

Compliance

Contracts are one of Procurement’s strongest methods for managing spend and supply chains. Unfortunately, internal buyers don’t always abide by them. In fact, out of contract buying, also known as maverick spend, non-compliance, or savings leakage, is one of Procurement’s most notorious problems.

Maverick buying hurts companies by ignoring the cost savings that come from contracts, introducing new vendors to the supply chain, and decreasing the company’s overall spend under management. Because it’s a widespread problem in so many organizations, it can add up to cost businesses millions of dollars.

Risk

Establishing strong supply chains is one of Procurement’s top priorities. Without them, spend is never really under control because there’s no guarantee that critical materials or services will be available. Because part of conducting a spend analysis is evaluating vendors, it gives Procurement an excellent opportunity to consider a few critical pieces of information:

- How many suppliers the business has

- How much the business is spending with each one

- What contracts the business has in place

- What contracts are set to expire

- What spend with each one has looked like over a given time period

By looking at this information, Procurement can identify gaps or spend trends that can create shortages and fulfillment issues that cost the business money or force it to spend even more to buy goods or services from an available vendor.

Non-financial Factors

For a long time, Procurement’s main responsibility revolved around money—how much was the company spending and how could Procurement minimize it? But a changing corporate landscape has added non-financial impact to the function’s responsibility list. So now, a core part of any spend analysis involves looking at ways that Procurement can help the company outside of saving it money.

We’ll explore these factors in more depth later. For now, it’s important to understand that because a spend analysis lets Procurement account for its vendors, it enables the function to consider strategic factors like non-financial risk and ESG and then direct their business toward suppliers who align with their non-financial goals.

Beyond Analytics: Harnessing Execution

A spend analysis is the first step to discovering opportunities for lowering costs or eliminating them altogether. But it’s not the only step, and teams who stop here only drive a portion of the value they’re capable of.

Of course, taking holistic action on addressable spend opportunities is easier said than done. It’s easy to treat a spend analytics tool like a tree and pick low-hanging fruit one project at a time. However, the best-in-class teams treat spend analytics as only the first step of their strategy. Once they can analyze their spend, they act on the opportunities they find in a unified, enterprise-wide manner. Here’s how they do it.

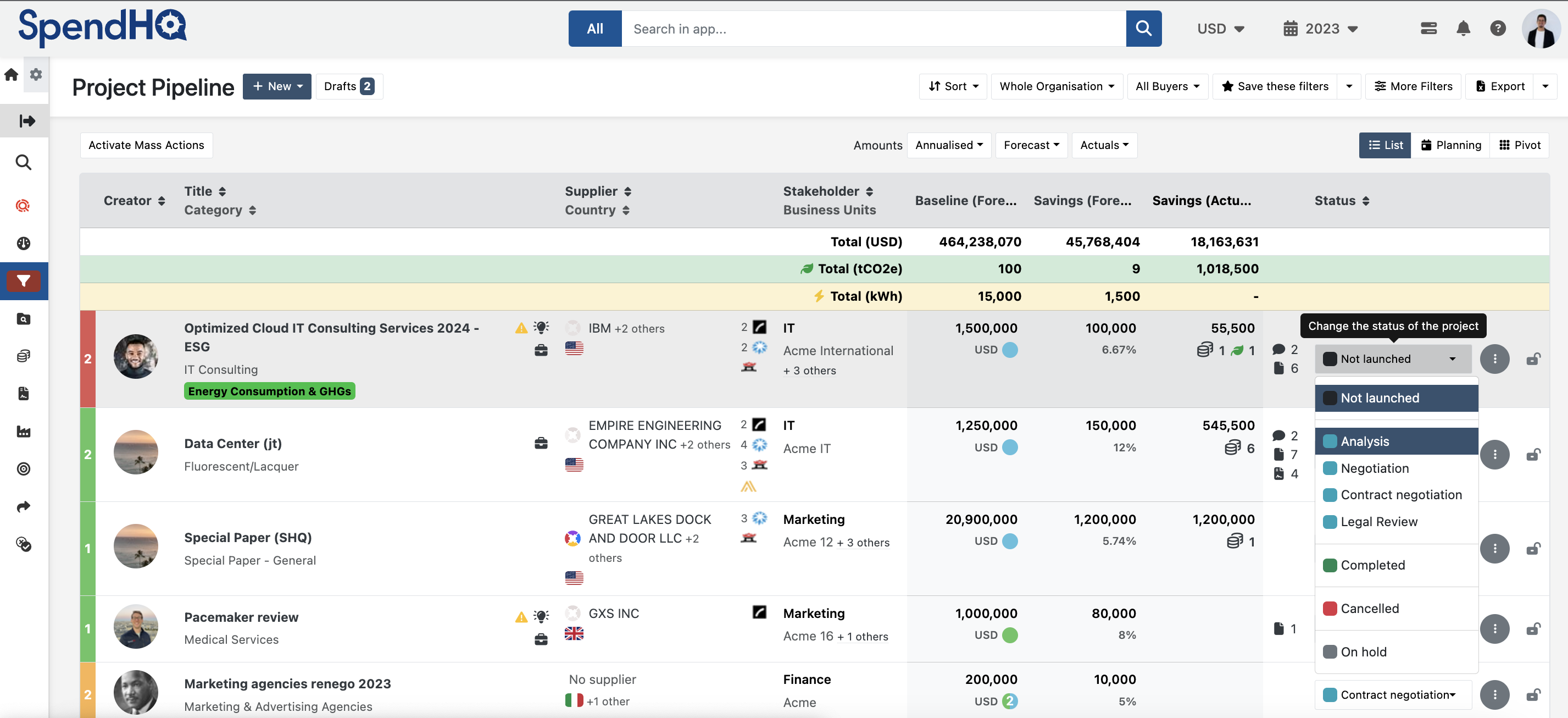

Managing Procurement Projects

Once a procurement team is able to leverage spend intelligence to discover opportunities for improvement, they’re ready to set projects. Choosing a project to work on is relatively easy, but setting the right projects at the right times and executing on them quickly can be tricky for a few reasons.

First, communicating on projects and rallying resources is difficult. The sheer size of modern businesses and Procurement’s responsibilities make this true, but the lack of communication tools built for purchasing and sourcing makes the problem even worse. Instead, many of them rely on spreadsheets and other documents that make communication breakdowns and lost information inevitable. Secondly, most Procurement projects involve formal events like requests for proposals (RFPs), requests for quotes (RFQs), reverse auctions, or contract negotiations. These events require precise coordination, often between teams on opposite sides of the globe. Without a way to communicate, Procurement teams struggle to coordinate and get the full benefit from these sourcing events.

Terms to Know:

- RFP – Request for proposal, the process of accepting proposals for goods and services from suppliers. RFPs usually overview price, quality, and service differentiators.

- RFQ – Request for quote, like an RFP, but an RFQ usually focuses on price

- Reverse auction – A sourcing event where vendors compete for business by offering increasingly lower prices.

- Contract negotiation – The act of negotiating with vendors’ sales teams to secure better terms and lower prices.

Instead, Procurement needs a way to make all of its projects and communication on them visible in one place. In our

Acting on spend management opportunities becomes simpler when teams everything Procurement is working on is visible in one place.

When Procurement and its key stakeholders can both track projects in real time, Procurement teams have the trust, alignment, and communication chains they need to gather resources and push projects across the finish line. In short, a strong project pipeline allows an enterprise-level business to become agile.

Without this kind of project pipeline, though, Procurement’s performance has a defined ceiling. Teams will still drive value and achieve cost savings, but they’ll leave a significant amount of untapped potential behind. Industry research makes this clear.

According to a 2023 study SpendHQ conducted with Procurious, 74% of Procurement teams are managing projects and tracking savings in desktop tools like spreadsheets. Additionally, 79% lack a dedicated procurement performance management solution. On top of that, Ardent Partners 2023 CPO Rising report revealed that the average team only has 64.9% of its spend under management.

That’s a significant amount of money for businesses to have very little control over. Of course, procurement performance management isn’t the only factor at play in this number. But when teams don’t have a strong way to track projects and communicate updates, they can’t come together to execute on all the opportunities in front of them. The result is less spend under management by extension.

Managing and Capitalizing on Supplier Contracts

As we’ve established, contracts are one of Procurement’s key spend management tools. They allow the function to set category management and supplier relationship management processes that run without their direct, active oversight. But contracts are only as effective as the way teams use them after signing. Simply finding and capitalizing on contract opportunities won’t do a business any good if Procurement can’t keep track of them.

First, teams that don’t know their contract details remain at the mercy of suppliers, even though contracts exist to create an equal balance of power. Without contracts, agreements on fulfillment and price per unit are just suggestions that vendors can easily forget to honor.

Secondly, teams cannot afford to let renewals and expirations fall through the cracks. Lapsed contracts erase the price-per-unit reductions that create most cost savings. They also introduce risk, scarcity, and unpaid POs that can harm relationships with vendors. Finally, losing track of contracts can cause category spending to balloon as buyers choose their own suppliers.

To avoid these issues, teams need to combine their contract repository with their performance management system so contracts are easy to access and no reminders go unnoticed. Not only does this protect the business from a disaster, but it also facilitates real spend management, which is an ongoing process that never ends at securing savings.

Reporting and Savings Tracking

Because spend management is an ongoing process, it’s also an iterative one. To truly drive meaningful impact, including top-line growth, teams should constantly be looking for ways to improve how they’re managing spend.

This means that evaluating results and making changes is as much a part of spend management as the initial search for opportunities. Evaluating reports, outcomes, and realized savings shows Procurement what worked, what didn’t, and what opportunities the team missed in a given period of time. It can also reveal new factors that they should be paying attention to and help them course correct for better results in the next year, quarter, or month. Finally, giving stakeholders real-time visibility naturally creates better results because it becomes much easier for everyone involved in a project to have the information they need.

Tracking this information also clears up questions about Procurement’s impact. By giving all stakeholders access to savings tracking, reporting, and customizable dashboards, PPM not only helps teams maximize their performance, it also helps them demonstrate its strategic importance. When Procurement becomes a trusted strategic partner, the function’s ability to positively impact the business automatically increases.

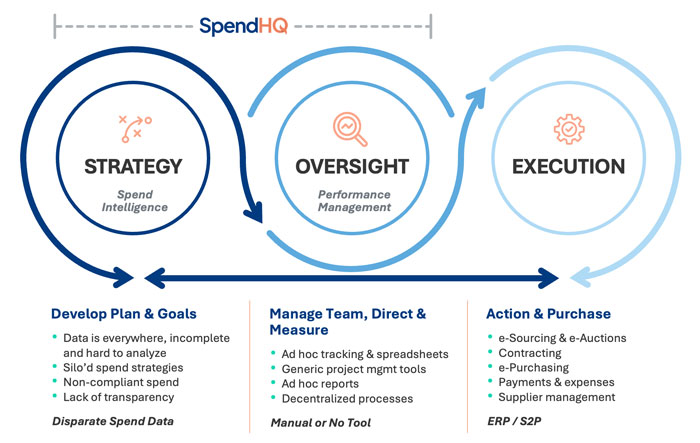

Putting it All Together

Now that we’ve broken down the spend management process from analytics to execution, let’s review what it all looks like put together.

First, a Procurement team consolidates its spend data and puts it into a spend analytics tool. In the case of Spend Intelligence, an artificial intelligence model will normalize and categorize the data, preparing the team for the next step. Once they’ve reviewed their data and made sure that it’s correct, the team is ready to start analyzing it.

To do this, they’ll drill down into their categories and subcategories and use various dashboards, filters, and other tools inside their spend management solutions to acquire unique perspectives on their spend data. Using these perspectives, they’ll identify the trends that are driving organizational spend and decide which ones they can impact and which ones they can’t. Specifically, they’ll be looking for spend management opportunities under four umbrellas:

- Addressable spend

- Compliance or savings leakage

- Risk

- ESG and other non-financial, strategic initiatives

Once they’ve found opportunities, it’s time to execute on them. Procurement has never been a stranger to pushing projects across the finish line, but to drive financial impact across the organization, the function needs a way to facilitate execution. This is known as Procurement Performance Management, and it accomplishes a number of goals:

- Establishing project visibility and communication with an interactive, real-time project pipeline

- Organizing contracts, making them accessible, and making sure renewals and expirations don’t fall through the cracks

- Making it easy to report and track the results of Procurement’s activities by giving teams and stakeholders real-time access to savings tracking

See also: Can you manage Procurement projects in a spreadsheet?

Spend Under Management Never Ends

It’s important to remember managing spend is not a once-and-done process. Spend management is more of a culture, or a way of thinking about procurement, than it is an exercise. To optimize a team’s impact and make it clear to key stakeholders, Procurement teams should be running the process we just overviewed on a regular basis for several reasons.

Spend management is an ongoing process that revolves around analyzing spend, executing on initiatives, and then looking for more opportunities.

First, organizational spend is a classic example of entropy. If it isn’t under constant management, it will find a way to get out of control. Buyers will start purchasing out of contract, purchase price variance (PPV) will creep in, inflation will cost the business money, supplier relationships will deteriorate, and spend will ultimately increase across the business.

Secondly, analyzing spend regularly creates increasing value for the business. The first few spend management cycles may only focus on correcting glaring problems with how an organization is purchasing, but subsequent cycles will built off that progress. A few months or years later, the business will have reached a new level of efficiency simply because Procurement is constantly looking for improvements.

Finally, regularly analyzing and managing spend allows Procurement to make spend management an automatic, process-led part of the business. When Procurement has the contracts, visibility, and processes in place to let categories run themselves, leaders can focus on higher-level, strategic concerns without worrying about the business falling apart.

ESG and Other Non-financial Sourcing Initiatives

Despite this guide’s focus on spend management, Procurement’s greatest potential doesn’t lie in how it can impact a business’ bottom line, at least not directly. Instead, it’s Procurement’s strategic potential that makes the function invaluable.

Because, at least in theory, Procurement influences everything a company buys, it can also influence almost everything the company does. There’s an obvious financial factor here—Procurement can influence the cost of goods and services, but the non-financial power that the function holds is arguably even more important. Before we close, let’s look at some of the ways Procurement can transform organizations without directly contributing to their bottom lines.

Risk Management

So far, we’ve touched on risk management only in regards to financial concerns. But there’s a lot more to risk than the danger of spending too much money.

For starters, one of Procurement’s responsibilities is to pick risk-resilient vendors that the company can rely on to deliver goods and services. If a vendor has a logistics breakdown or an issue in its own supply chain, that can create material shortages that keep the company from shipping orders, producing products, or fulfilling its role as a vendor to other companies.

Procurement also helps mitigate safety concerns by forming a strong MRO supply chain so maintenance, inspections, and repair parts are all accessible. Without Procurement’s involvement, companies would face more safety incidents. Finally, Procurement reduces the risk of fraud by overseeing, reviewing, and analyzing purchasing organization-wide.

These are just three examples of how Procurement helps companies mitigate risk. There are nearly endless ways that the function protects companies by forming strong supply chains and fostering relationships with vendors. But none of this can happen without a strong focus on spend management. Without it, Procurement has very little visibility into supply chain depth, vendor gaps, and organization-wide spending.

Legal Compliance

The regulatory landscape is always changing and because Procurement sits over organizational purchasing, the function plays a crucial role in keeping companies on the right side of the law. Whether the company is buying hazardous materials, shipping dangerous cargo, or handling data, Procurement can protect it by using its spend management influence to work with reputable vendors throughout the supply chain.

This is especially important for companies doing business in multiple countries that may have different regulatory codes. For example, GDPR requirements protect data belonging to EU citizens. However, they apply to any company doing business in the EU. By actively managing spend and partnering with IT, Procurement can ensure that digital investments and data partnerships are secure and compliant with GDPR regulations.

Supplier relationships

As SpendHQ’s Chief Product Officer Pierre Laprée recently said in an interview, “One of the only ways to address scarcity and shortages is to become a customer of choice for your suppliers.” It’s a well-known fact that when fulfillment breaks down, suppliers often take care of their favorite customers first. Since Procurement interacts with vendors at the most strategic level, especially when the function is at its most mature, this gives it the chance to secure big wins for the company simply by going the extra mile in supplier relationship management.

Brand identity

In today’s world, consumers know more about supply chains than ever before, and they use that knowledge to hold companies accountable. Just look at how the public reacted to finding out that several food distributors were sourcing from suppliers engaged in unethical labor practices. Procurement can help businesses avoid tarnishing their brand images by managing spend in a way that keeps them aware of how their suppliers conduct business.

ESG and Corporate Social Responsibility

Of all the non-financial indicators that Procurement can focus on, ESG and Corporate Social Responsibility have become some of the most important. For many businesses, ESG creates new investment opportunities and influences how the public and potential partners perceive the organization. However, these non-financial factors also allow companies to make a positive impact on the world around them and increase their sustainability in a way that allows them to remain operational for years to come. Let’s look at what each letter of ESG is about.

Using Spend Management to Care for the Environment

Environmental factors involve anything related to scope 3 carbon emissions, resource usage, recycling, sustainability, pollution, waste, and safe treatment of manufacturing materials. Procurement’s role in the environmental sector usually revolves around working with suppliers who operate sustainably and finding ways to move away from vendors with large and unchanging carbon footprints. It may also involve looking for ways to use less plastic and even recycle materials to reduce waste.

The Union of Spend Management and Social Responsibility

Procurement’s involvement in the social part of ESG revolves around diversifying supply chains, specifically by contracting with diverse businesses.

What is a Diverse Supplier?

Minority-owned businesses

- Women-owned businesses

- LGBTQ-owned businesses

- Small businesses

- Veteran-owned businesses

- Disadvantaged businesses

- HUBzone small certified businesses

- Service-disabled veteran-owned small businesses

- Veteran-owned small businesses

- Small-disadvantaged businesses

To some extent, the social part of ESG also involves the behavior of vendors, including fair trading, human and workers’ rights, and anti-slavery commitments. While these have not traditionally been a part of ESG, they’re growing in importance and attracting more attention than ever before. They also require extra data, beyond what a simple spend analysis would involve, but with enrichment data from third parties like Supplier.io, Procurement teams can make supplier diversity a routine part of their spend management efforts.

Using Spend Management to Focus on Governance

Finally, governance is related to how companies make ethical decisions and involve underrepresented communities into them. This may look like diversifying boardrooms or setting up checks and balances to ensure ethical use of data and funds.

Procurement doesn’t focus on governance as much as environmental and social factors, but it’s a key factor to consider when choosing new vendors. Not only does it drive funds toward ethical businesses, but it can also protect the company by partnering with businesses that are scandal and incident-averse.

Frequently Asked Questions

Looking for better spend management strategies and tactics can bread questions. Here are some that we hear often.

How Can Teams Balance Spend Management with ESG Priorities?

Spend management and ESG can seem like unrelated, even opposed strategies since ESG isn’t primarily focused on cutting costs. In fact, ESG initiatives can even raise prices. But they also come with financial incentives:

- Green investment opportunities

- New paths for business

- Decreased or eliminated carbon taxes

- Elevated brand reputation

You don’t have to choose between costs and ESG. If your team has holistic spend intelligence, you can easily pair cost reduction projects with green investments or lower prices by negotiating contracts with diverse suppliers.

What is a Spend Strategy?

A spend strategy is a plan that identifies sourcing projects and purchasing programs that Procurement can use to reach a specific goal for organizational spending. Most spend strategies focus on negotiating vendor contracts, eliminating unnecessary purchases, and increasing compliance to lower spend. However, spend strategies can also focus on spending more with diverse suppliers and eco-friendly vendors.

What’s the Difference Between Spend Management and Expense Management?

Spend management is a high-level strategy. It focuses on controlling, reducing, and directing spend at scale. A good example of spend management is negotiating small parcel shipping: what vendors the company uses and how much it pays for the service.

Expense management deals with employee spending on reimbursable business expenses like travel and business purchases. It’s usually an accounting priority that involves reimbursements. However, Procurement can make it a spend management matter by negotiating vendor contracts to lower per unit prices. Special pricing with a hotel chain or airline are classic examples.

What are Some Key Challenges in Spend Management?

Managing spend at the enterprise level is difficult for several reasons, including:

- Procurement’s data is messy, unwieldy, and outdated without a spend analytics platform.

- Silos make procurement management impossible without a single source of truth for projects and result

- Finance rarely trusts Procurement’s savings reports because they’re divorced from context.

- Purchasing program compliance is a constant game of catch up

- Procurement struggles to secure tech budgets because its perceived role is to eliminate spending.

Some of these challenges are process-related. But Procurement can solve most of them by centralizing spend data and managing procurement performance with efficient digital tools.

Conclusion

Knowing how to manage organizational spend has always been a non-negotiable Procurement skill. But as businesses have become more connected to the global economy than ever before, the complexities of spend management have grown as well. Now, the process is a strategic endeavor that spans all the way from source to contract.

However, it goes far deeper than simply cutting costs and contracting with the least expensive vendors. Modern spend management is about leveraging spend intelligence to find as many financial and non-financial value creation opportunities as possible, executing on them, and then repeating the process again and again.

While this may seem like a significant amount of work, the results speak for themselves. Teams that comb their spend data and act on the opportunities they find are driving business forward, and their impact doesn’t stop at top-line growth or bottom-line improvements. These teams are making companies more efficient, more risk-resilient, and more sustainable. Everyone wins when Procurement manages spend.

If you’re ready to have that kind of impact on your business, then it’s time for you to harness the power of Procurement’s strategic Procurement Platform. By combining the deep spend insights you’ll get with Spend Intelligence and the process excellence that comes from Procurement Performance Management, you and your team will be well-equipped to extract and execute on spend management opportunities. Your strategic impact is waiting; click below now to schedule a risk-free demo and experience the power of a vision to action framework for yourself.